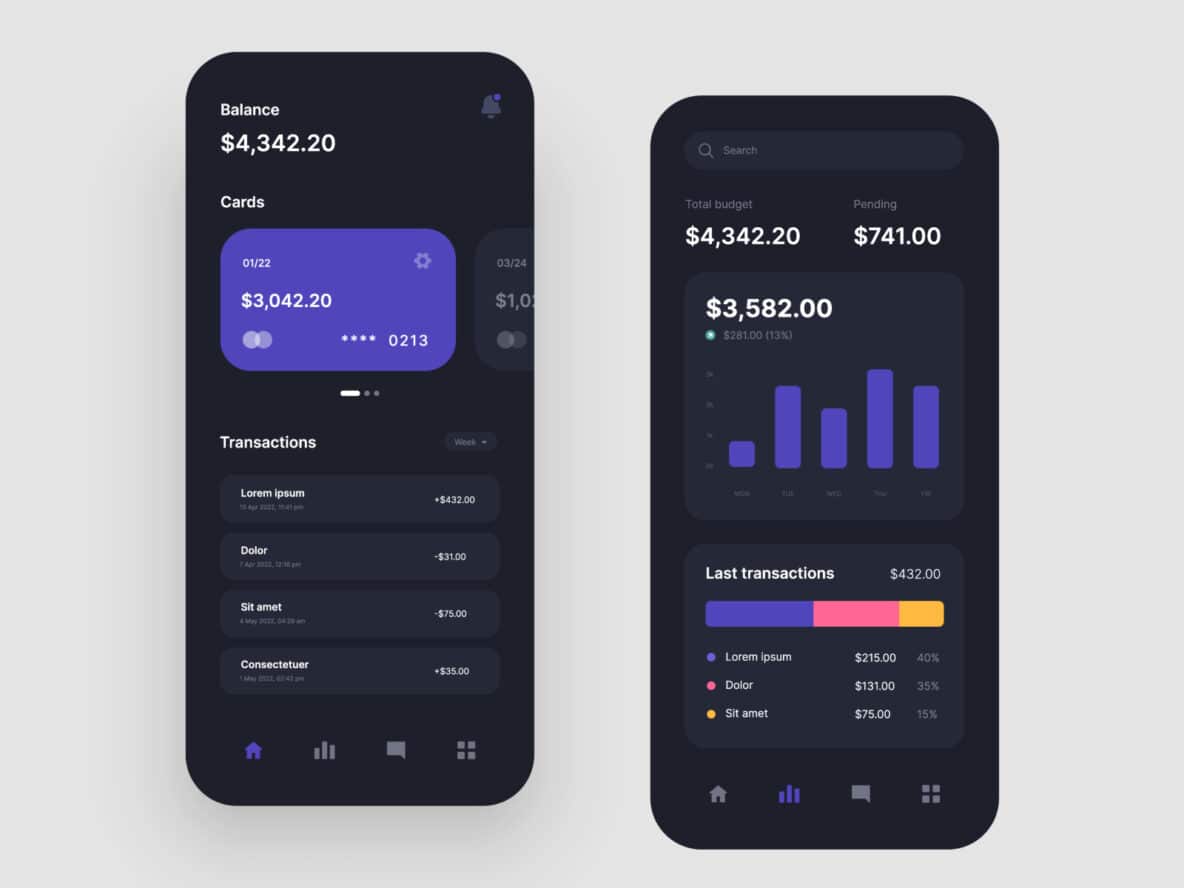

Client Overview: Leading Fintech Innovator

Creative27 was approached by a leading fintech company known for its revolutionary approach to digital banking solutions. This client, operating in a highly regulated industry, required a robust and secure mobile banking application capable of handling sensitive financial data and transactions while ensuring a seamless user experience.

Security Demands

Given the nature of the financial sector, the client’s primary concern was security. The project required compliance with stringent regulations, including PCI DSS (Payment Card Industry Data Security Standard), GDPR (General Data Protection Regulation), and various other international security standards. Key security demands included:

- Data Encryption: Ensuring end-to-end encryption of sensitive data.

- Authentication and Authorization: Implementing multi-factor authentication (MFA) and secure user access controls.

- Secure Data Storage: Protecting data at rest with advanced encryption techniques.

- Real-Time Threat Monitoring: Continuous monitoring for potential security threats and vulnerabilities.

- Compliance: Meeting industry-specific regulatory requirements.

Creative27’s Security Strategies and Technologies

Creative27 leveraged its extensive expertise in digital security to address these demands through a multi-faceted approach:

- End-to-End Encryption:

- TLS/SSL Protocols: Implemented Transport Layer Security (TLS) and Secure Sockets Layer (SSL) protocols to encrypt data transmitted between the app and the server.

- AES Encryption: Used Advanced Encryption Standard (AES) for encrypting data at rest and in transit, ensuring data remained secure even if intercepted.

- Multi-Factor Authentication (MFA):

- Biometric Verification: Integrated biometric authentication methods, such as fingerprint and facial recognition, to add an extra layer of security.

- One-Time Passwords (OTPs): Employed OTPs for critical transactions to ensure only authorized users could perform sensitive operations.

- Secure Data Storage:

- Encrypted Databases: Utilized encrypted databases to store sensitive information, ensuring data security even if physical access to storage devices was compromised.

- Tokenization: Implemented tokenization to replace sensitive data with unique identification symbols, rendering it useless if breached.

- Real-Time Threat Monitoring and Incident Response:

- SIEM Systems: Deployed Security Information and Event Management (SIEM) systems to continuously monitor and analyze security events in real-time.

- Automated Incident Response: Set up automated responses to detected threats, minimizing the impact of potential breaches.

- Regulatory Compliance:

- Regular Audits: Conducted frequent security audits and vulnerability assessments to ensure compliance with PCI DSS, GDPR, and other relevant standards.

- Data Privacy Policies: Established comprehensive data privacy policies and procedures to align with regulatory requirements.

Impact on Project Success

The implementation of rigorous security measures by Creative27 significantly enhanced the project’s success in several key areas:

- User Trust and Confidence: The robust security protocols ensured that users felt their financial data was safe and protected. This trust led to higher adoption rates and increased user engagement, as customers felt confident in using the mobile banking application for their financial transactions.

- Regulatory Compliance and Smooth Launch: By meeting all regulatory requirements, including PCI DSS and GDPR, the application smoothly passed through all compliance checks. This not only expedited the launch process but also prevented potential legal and regulatory complications, ensuring a timely market entry.

- Fraud Prevention and Security: The advanced security features, such as multi-factor authentication and real-time threat monitoring, played a crucial role in minimizing fraudulent activities. This proactive approach to security significantly reduced the risk of breaches and unauthorized access, protecting both the client’s assets and their customers’ data.

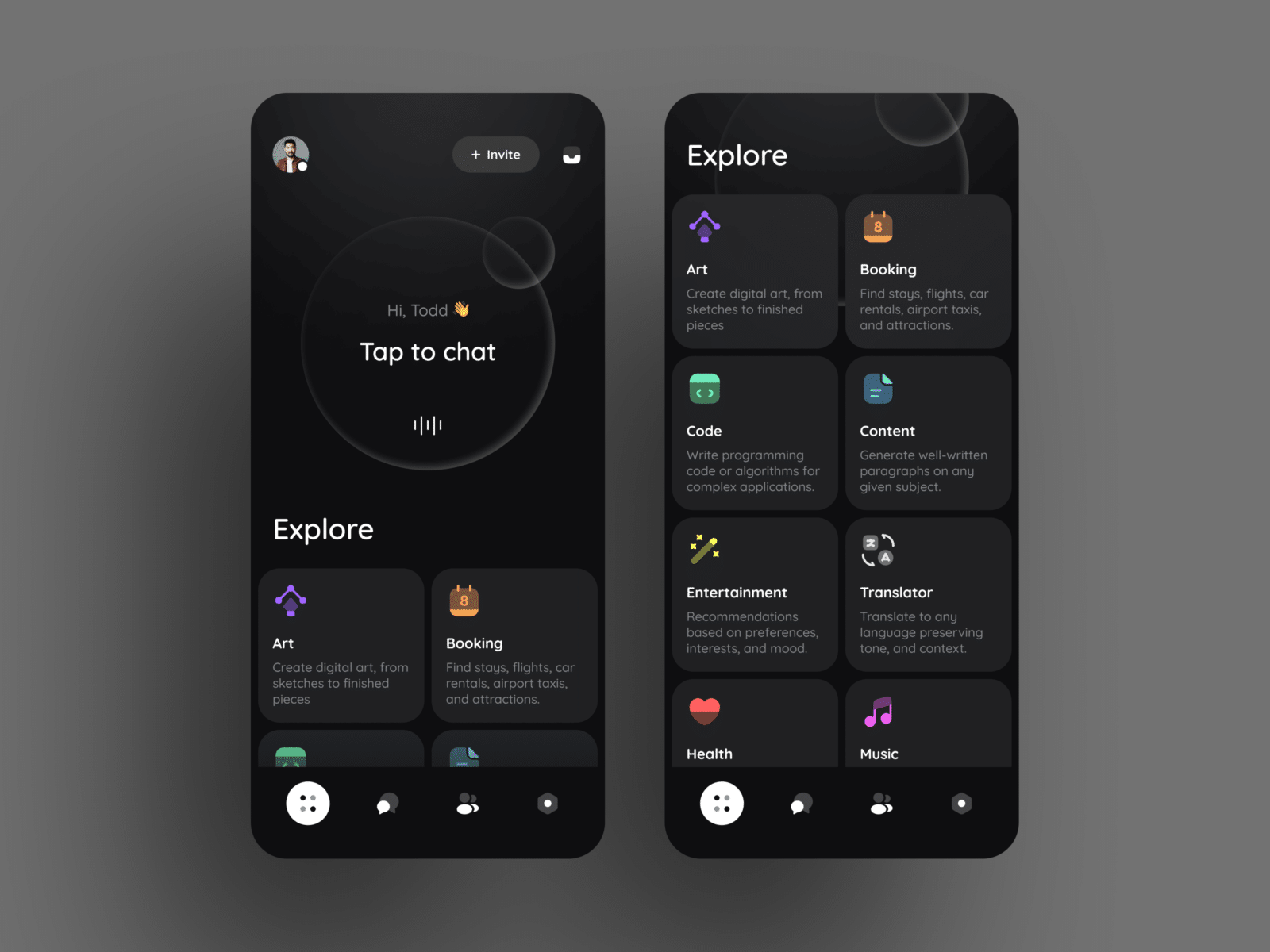

- User Experience and Satisfaction: Despite the stringent security measures, Creative27 ensured that the user experience remained seamless and user-friendly. The integration of features like biometric authentication not only enhanced security but also made accessing the app more convenient for users, leading to high levels of customer satisfaction and loyalty.

- Brand Reputation and Market Positioning: The successful implementation of top-tier security measures positioned the client as a leader in secure fintech solutions. This reputation for security attracted more users and business partners, bolstering the client’s market position and competitive edge in the fintech industry.

- Long-Term Client Relationship: The client’s satisfaction with Creative27’s expertise and dedication to security fostered a strong, long-term partnership. This relationship opened the door for future collaborations, with the client confident in Creative27’s ability to deliver secure and innovative digital solutions.

Client Satisfaction and Business Objectives

The client was extremely satisfied with Creative27’s commitment to security. The agency’s ability to meet stringent security requirements not only protected the client’s assets but also positioned them as a trusted and secure fintech solution provider in the market. This trust translated into increased user engagement and retention, driving the client’s business objectives forward and solidifying their reputation in the industry.

By addressing the client’s critical security needs with innovative solutions, Creative27 demonstrated its expertise and reliability, ultimately fostering a long-term partnership and opening doors to future collaborations in the fintech sector.

For more information on how Creative27 can enhance your digital product’s security, book a free call to discuss your project with us.